An Update on State Preceptor Tax Incentives: Where Do We Stand?

As programs continue to grapple with the challenge of securing clinical rotations for students, PAEA’s Government Relations team is committed to supporting policy interventions designed to expand clinical education capacity.

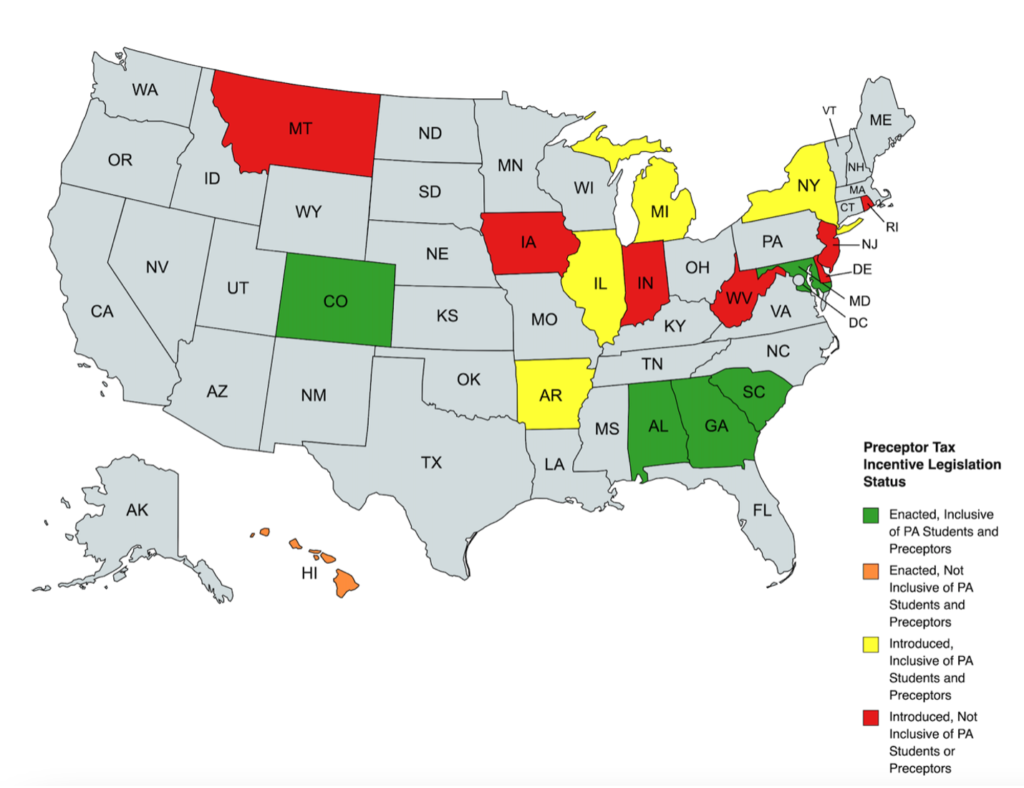

While many of PAEA’s efforts are focused on the federal level, state policy also offers a critical opportunity for clinical preceptor recruitment through incentives such as income tax credits and deductions. In the past decade, interest in this strategy among state policymakers has grown significantly with 17 states having either enacted or introduced preceptor tax incentive legislation.

In 2014, Georgia became the first state to enact legislation to address the clinical training site shortage through a state-based tax incentive. Originally structured as a relatively modest deduction, state legislators significantly expanded the program in 2019, converting the deduction to a more generous tax credit, thereby allowing preceptors to claim up to $8,500 annually to reduce their state income tax liability in exchange for training students. The success of this approach has led to increased adoption in other states by legislators seeking to improve workforce retention in their communities.

As of 2023, five states – Georgia, Maryland, Colorado, South Carolina, and Alabama – have tax incentives that are inclusive of both PA preceptors and students. While these states have achieved significant progress, work remains in other states to ensure full inclusion of PA preceptors and students in either pending legislation or existing law. For example, Hawaii has enacted legislation that is not yet inclusive of PA students or preceptors, though legislation to expand eligibility has been introduced. Several states, including New York, Michigan, Illinois, and Arkansas, have introduced legislation that is inclusive of PA students and preceptors, while other states, including Rhode Island, New Jersey, West Virginia, Indiana, Iowa, and Montana, have introduced legislation that excludes PA preceptors and/or students.

As many states are preparing for their 2024 legislative sessions, PA faculty can play a key role in promoting the advancement of either previously introduced or new tax incentive legislation through grassroots advocacy. PAEA has collaborated with AAPA to support the development of model state legislation that can be shared with state chapters and legislators seeking to strengthen health workforce development through increased clinical training opportunities. Additionally, members interested in hearing the perspectives of state advocacy leaders who have successfully advanced preceptor tax incentive legislation in their states can access a webinar recording in PAEA’s Digital Learning Hub. Finally, PAEA’s Grassroots Advocacy Resource Guide includes comprehensive tips on how to effectively engage with state legislators to advance the interests of PA education.

Members with questions about state tax incentives or PAEA’s advocacy initiatives are invited to contact Tyler Smith at tsmith@PAEAonline.org.